If that rises by 13 per cent in 2023, that will rise to £216.41 a month. The Lib Dems illustrated the effect of the rise by looking at the example of someone buying an average-price house (£264,000) with a 25-year Loan-to-value mortgage at an average 2 per cent interest rate.Īt present, they are paying £191.52 a month in interest. “People who work hard and follow the rules deserve fair treatment.” It is time to end the tax hikes, and to solve this cost-of-living crisis to stop this ticking mortgage bomb. How is he going about addressing a mortgage crisis if he can’t manage the cost of living crisis? The way he ignored the cost-of-living crisis in the budget was reckless and out of touch. “This ghastly forecast should send chills down the Chancellor’s spine. Sir Ed said, “The Chancellor has created a perfect storm.” It is now the worst moment in a generation for homeowners.īritish homeowners face a toxic cocktail of interest rates rises, house price increases, and council tax hikes. The combination of record house prices as well as years of low interest rates has led to the predicted rise. However, rising energy costs have made it more expensive to run a business from home. We set up the business to work remotely during the pandemic. “After a difficult few decades in which the music industry has been severely affected by the pandemic, I was hoping for green initiatives to lower the cost of living. She said that we were one of three million self-employed people who didn’t get any help. Mrs Knight stated that she was not eligible for the Self Employed Income Support Scheme because of strict guidelines. But they have not received the help that they were hoping for.

They had hoped that the Government would offer green home incentives to assist them in becoming more eco-friendly. However, they have been holding off on the £8,000 to £10,000 expenditure. They had hoped that solar panels would help reduce this. Their electricity bills with Bulb, a renewable energy company has doubled in the last month. But they were left without the funds to continue the project. They were able to rewire their home and get it insulated before the pandemic struck. They moved from London to buy their current home, with the intention of renovating it to be as eco-friendly and sustainable as possible. She said that running their household will not get any cheaper.

Mrs Knight stated that it was disappointing that no green initiatives had been announced. They waited eagerly to see if there would be any Government announcements that would help them. They were also worried about rising living costs. The couple, from Great Missenden in Buckinghamshire, had a house to remodel and soaring energy costs.

It records classical nursery rhymes and keeps them at home with Darcey, their newborn baby. Instead, they started their own business, Treble and Trumpet. She and her husband, a trombonist in the Philharmonic Orchestra’s Trombone Section, lost all of their income during the pandemic. Mrs Knight, 34, a singer in English National Opera, stated that the inflation rate could have an impact on her re-mortgage. They fear that interest rates will rise to 5%, and they could end up paying significantly more than they planned to once their fixed rate of 2 percent ends in a year. The couple are paying around £1,200 a month for their mortgage on their detached house – more than they were prior to the pandemic as they took advantage of a mortgage holiday.

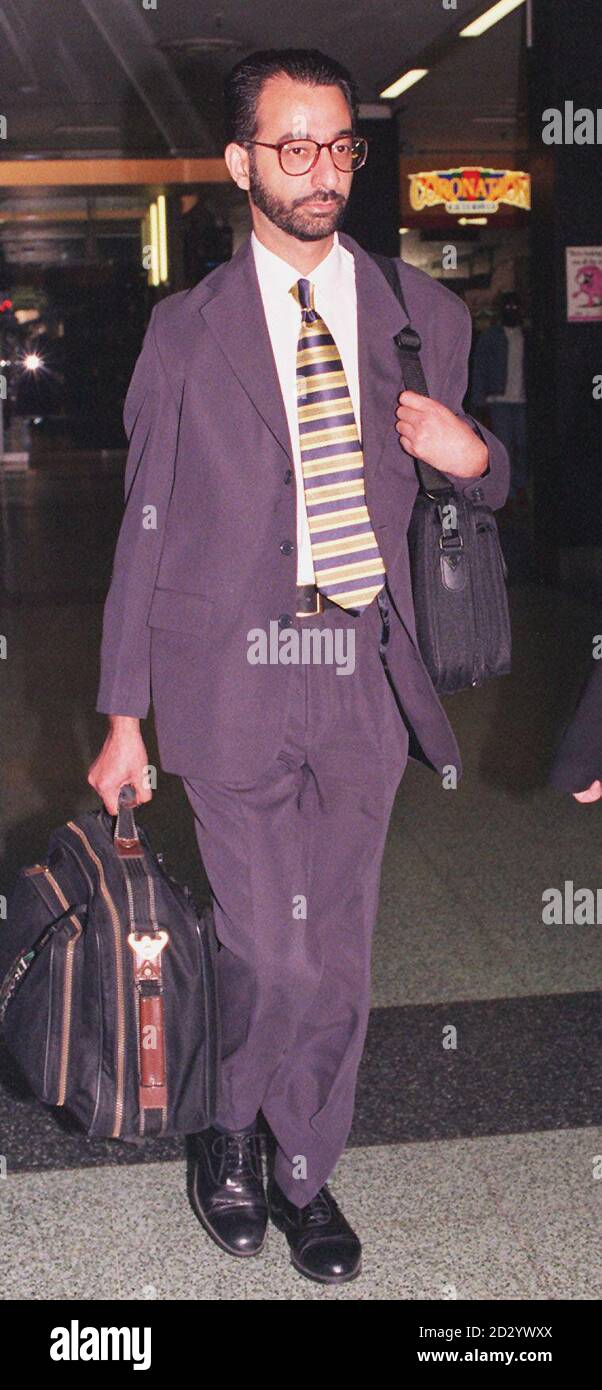

Matthew and Lucy Knight (pictured with Darcey, their one-year old daughter) fear rising inflation will force them to flee. They use the OBR’s central forecast, which predicts interest rates rising to 0.75 percent. These figures were included in documents published by OBR along with yesterday’s Budget. He said that it could lead to homeowners struggling to keep up with rising inflation, and rising mortgage costs. Sir Ed Davey, the leader of the Liberal Democrats, warned that this is the greatest threat homeowners face since the 2008 financial crash. The Liberal Democrats said the predicted future increases could add £300 onto the typical mortgage in a year. Shaw Financial Services, Mansfield, Nottinghamshire mortgage expert Lewis Shaw, advised calm, but also advised MailOnline that people should “talk to a brokerage, cut back unnecessary spending, make overpayments on their mortgage while rates are low”.Īshley Thomas, Magni Finance director in London, stated that he had observed ‘a number lenders slightly increase their rate over the last week’, and that it was ‘inevitable’ that rates would rise going forward. This would be followed by a further rise of 5.4% the following year.

0 kommentar(er)

0 kommentar(er)